Chen and Chi left their infant son with Chi’s parents before heading over to Abacus.

The closing meeting for the house took place on the morning of December 11th. Chen had already begun mapping out in his head which half of the house the family would live in, which half they’d rent out, where they’d put the nursery. Chen’s parents wired funds from China, which they had borrowed using their home as collateral. They agreed on terms, and in the weeks that followed the bank obtained employment documents while the couple wrote checks and submitted letters accounting for money family members had given them.

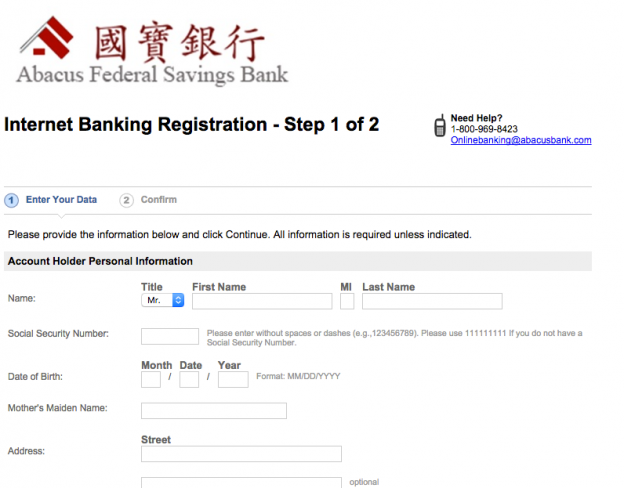

He said that getting a loan would be easy if they just left everything to him. Yu was only a few years older, and, it turned out, was from Chen’s home town, the coastal city of Wenzhou. For more than two decades, Abacus had grown at a healthy rate the year that Chi and Chen applied for their loan, it had six branches and some hundred and fifty employees, and originated about half a billion dollars in loans.Īt the Abacus headquarters, Chen and Chi went to the loan office, on the third floor, and were greeted by a stocky, talkative man named Ken Yu. It is one of a dozen or so community banks in Chinatown that cater to immigrants, including undocumented ones, who often inhabit a cash economy and mistrust mainstream banks. A hair washer told him, “It approves loans without too much fuss.”Ībacus was founded thirty years ago by Thomas Sung, a lawyer and a real-estate investor who had come from China in his teens. His co-workers at the salon suggested a solution. Many people he knew in Chinatown had similar problems. “We were asking everywhere,” he told me in Mandarin when I visited him recently at the salon. Chen had no credit history and was paid largely in cash. The subprime-mortgage crisis of 2008 had exposed lax lending standards throughout the banking industry and credit was tight. The asking price was seven hundred and eighteen thousand dollars, and they began putting together a down payment with money from savings and relatives. Looking around the neighborhood, they found one with a small garden out front. The plan was to buy a two-family house and rent out one of the units.

They’d been living in Chen’s studio apartment, not far away, but Chi was now pregnant with their first child and they needed a bigger place. They had been married for a year and spent almost all their time in New York’s various Chinese enclaves, especially Bensonhurst, Brooklyn, where Chen worked at a hair salon. Chen, her husband, who was a year younger, had arrived in his late teens and spoke little English. Chi, who was twenty-four and worked in customer service at a pharmaceutical company, had spent nearly her entire life in the United States, after her family came from Taiwan. One afternoon in the fall of 2009, Jie Chen and Ariel Chi walked into the headquarters of Abacus Federal Savings Bank, near Canal Street, to inquire about a mortgage.

0 kommentar(er)

0 kommentar(er)